How to read an Income Statement

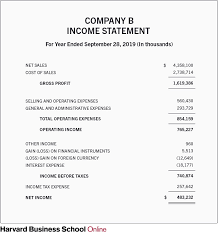

How to read an Income Statement (also referred to as profit & loss statement (P&L), revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations) is a company’s financial statement that indicates how the revenue (money received from the sale of products and services before expenses are taken out, also known as the “top line”) is transformed into the net income (the result after all revenues and expenses have been accounted for, also known as Net Profit or the “bottom line”). It displays the revenues recognized for a specific period, and the cost and expenses charged against these revenues, including write-offs (e.g., depreciation and amortization of various assets) and taxes. The purpose of the income statement is to show managers and investors whether the company made or lost money during the period being reported.

The important thing to remember about How to read an Income Statement represents a period of time. This contrasts with the balance sheet, which represents a single moment in time.

Charitable organizations that are required to publish financial statements do not produce an income statement. Instead, they produce a similar statement that reflects funding sources compared against program expenses, administrative costs, and other operating commitments. This statement is commonly referred to as the statement of activities. Revenues and expenses are further categorized in the statement of activities by the donor restrictions on the funds received and expended.

Why You Should I Hire an Accountant For a Small Company? How to read an Income Statement properly is complex and can be prepared in one of two methods. The Single Step income statement takes a simpler approach, totaling revenues and subtracting expenses to find the bottom line. The more complex Multi-Step income statement (as the name implies) takes several steps to find the bottom line, starting with the gross profit. It then calculates operating expenses and, when deducted from the gross profit, yields income from operations. Adding to income from operations is the difference in other revenues and other expenses. When combined with income from operations, this yields income before taxes. The final step is to deduct taxes, which finally produces the net income for the period measured.

Usefulness and limitations of How to read an income statement

- Income statements should help investors and creditors determine the past financial performance of the enterprise, predict future performance, and assess the capability of generating future cash flows through reports of the income and expenses.

- However, information about an income statement has several limitations:

- Items that might be relevant but cannot be reliably measured are not reported (e.g. brand recognition and loyalty).

- Some numbers depend on accounting methods used (e.g. using FIFO or LIFO accounting to measure inventory level).

- Guidelines for statements of comprehensive income and income statements of business entities are formulated by the International Accounting Standards Board and numerous country-specific organizations, for example, the FASB in the U.S.

- Names and usage of different accounts in the income statement depend on the type of organization, industry practices, and the requirements of different jurisdictions.

If applicable to the business, summary values for the following items should be included in How to read an Income Statement:

Operating section

- Revenue – Cash inflows or other enhancements of assets of an entity during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major operations. It is usually presented as sales minus sales discounts, returns, and allowances. Every time a business sells a product or performs a service, it obtains revenue. This often is referred to as gross revenue or sales revenue.

- Expenses – Cash outflows or other using up of assets or incurrence of liabilities during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major operations.

- Cost of Goods Sold (COGS) / Cost of Sales – How to read an Income Statement represents the direct costs attributable to goods produced and sold by a business (manufacturing or merchandizing). It includes material costs, direct labor, and overhead costs (as in absorption costing), and excludes operating costs (period costs) such as selling, administrative, advertising or R&D, etc.

- Selling, General, and Administrative expenses (SG&A or SGA) – consist of the combined payroll costs. SGA is usually understood as a major portion of non-production related costs, in contrast to production costs such as direct labor.

- Selling expenses – represent expenses needed to sell products (e.g. salaries of salespeople, commissions and travel expenses, advertising, freight, shipping, depreciation of sales store buildings and equipment, etc.).

- General and Administrative (G&A) expenses – represent expenses to manage the business (salaries of officers/executives, legal and professional fees, utilities, insurance, depreciation of office building and equipment, office rents, office supplies, etc.).

- Depreciation / Amortization – the charge concerning fixed assets / intangible assets that have been capitalized on the balance sheet for a specific (accounting) period. It is a systematic and rational allocation of cost rather than the recognition of market value decrement.

- Research & Development (R&D) expenses – represent expenses included in research and development.

How to read an Income Statement expenses recognized in the income statement should be analyzed either by nature (raw materials, transport costs, staffing costs, depreciation, employee benefit, etc.) or by function (cost of sales, selling, administrative, etc.). (IAS 1.99) If an entity categorizes by function, then additional information on the nature of expenses, at least, – depreciation, amortization, and employee benefits expense – must be disclosed. (IAS 1.104) The major exclusive of costs of goods sold are classified as operating expenses. These represent the resources expended, except for inventory purchases, in generating the revenue for the period. Expenses often are divided into two broad sub classifications selling expenses and administrative expenses.

How to read an Income Statement Non-operating section

- Other revenues or gains, including capital gains – revenues and gains from other than primary business activities (e.g. rent, income from patents). It also includes unusual gains that are either unusual or infrequent, but not both (e.g. gain from the sale of securities or gain from the disposal of fixed assets)

- Other expenses or losses – expenses or losses not related to primary business operations, (e.g. foreign exchange loss).

- Finance costs – costs of borrowing from various creditors (e.g. interest expenses, bank charges).

- Income tax expense – the sum of the amount of tax payable to tax authorities in the current reporting period (current tax liabilities/ tax payable) and the amount of deferred tax liabilities (or assets).

How to read an Income Statement Irregular items

- They are reported separately because this way users can better predict future cash flows – irregular items most likely will not recur. These are reported net of taxes.

- Discontinued operations are the most common type of irregular items. Shifting business location(s), stopping production temporarily, or changes due to technological improvement do not qualify as discontinued operations. Discontinued operations must be shown separately.

- The cumulative effect of changes in accounting policies (principles) is the difference between the book value of the affected assets (or liabilities) under the old policy (principle) and what the book value would have been if the new principle had been applied in the prior periods. For example, the valuation of inventories using LIFO instead of the weighted average method. The changes should be applied retrospectively and shown as adjustments to the beginning balance of affected components in Equity. All comparative financial statements should be restated. (IAS 8)

- However, changes in estimates (e.g. estimated useful life of a fixed asset) only require prospective changes. (IAS 8)

- No items may be presented in the income statement as extraordinary items under IFRS regulations, but are permissible under US GAAP. (IAS 1.87) Extraordinary items are both unusual (abnormal) and infrequent, for example, unexpected natural disasters, expropriation, prohibitions under new regulations. [Note: natural disaster might not qualify depending on location (e.g. frost damage would not qualify in Canada but would in the tropics).]

- Additional items may be needed to fairly present the entity’s results of operations. (IAS 1.85)

How to read an income statement with Financial Statement Disclosures or Footnotes

- Certain items must be disclosed separately in the notes (or the statement of comprehensive income), if material, including:[3] (IAS 1.98)

- Write-downs of inventories to net realizable value or of property, plant, and equipment to recoverable amount, as well as reversals of such write-downs

- Restructurings of the activities of an entity and reversals of any provisions for the costs of restructuring

- Disposals of items of property, plant, and equipment

- Disposals of investments

- Discontinued operations

- Litigation settlements

- Other reversals of provisions

How to read an Income Statement Earnings per share

- Because of its importance, earnings per share (EPS) are required to be disclosed on the face of the income statement. A company that reports any of the irregular items must also report EPS for these items either in the statement or in the notes.

- There are two forms of EPS reported:

- Basic: in this case “weighted average of shares outstanding” includes only actual stocks outstanding.

- Diluted: in this case “weighted average of shares outstanding” is calculated as if all stock options, warrants, convertible bonds, and other securities that could be transformed into shares are transformed. This increases the number of shares and so EPS decreases. Diluted EPS is considered to be a more reliable way to measure EPS.

“Bottom line” is the net income that is calculated after subtracting the expenses from revenue. Since this forms the last line of the income statement, it is informally called the “bottom line.” It is important to investors as it represents the profit for the year attributable to the shareholders.

After revision to IAS 1 in 2003, the Standard is now using profit or loss for the year rather than net profit or loss or net income as the descriptive term for the bottom line of the income statement.

How to read an Income Statement and Requirements of IFRS

- On 6 September 2007, the International Accounting Standards Board issued a revised IAS 1: Presentation of Financial Statements, which is effective for annual periods beginning on or after 1 January 2009.

- A business entity adopting IFRS must include:

- a Statement of Comprehensive Income or

- two separate statements comprising:

- an Income Statement displaying components of profit or loss and

- a Statement of Comprehensive Income that begins with profit or loss (bottom line of the income statement) and displays the items of other comprehensive income for the reporting period. (IAS1.81)

- All non-owner changes in equity (i.e. comprehensive income ) shall be presented in either in the statement of comprehensive income (or in a separate income statement and a statement of comprehensive income). Components of comprehensive income may not be presented in the statement of changes in equity.

- Comprehensive income for a period includes profit or loss (net income) for that period and other comprehensive income recognized in that period.

- All items of income and expense recognized in a period must be included in profit or loss unless a Standard or an Interpretation requires otherwise. (IAS 1.88) Some IFRSs require or permit that some components to be excluded from profit or loss and instead to be included in other comprehensive income. (IAS 1.89)

How to read an Income Statement Items and disclosures

- The statement of comprehensive income should include:[3] (IAS 1.82)

- Revenue

- Finance costs (including interest expenses)

- Share of the profit or loss of associates and joint ventures accounted for using the equity method

- Tax expense

- A single amount comprising the total of (1) the post-tax profit or loss of discontinued operations and (2) the post-tax gain or loss recognized on the disposal of the assets or disposal group(s) constituting the discontinued operation

- Profit or loss

- Each component of other comprehensive income classified by nature

- Share of the other comprehensive income of associates and joint ventures accounted for using the equity method

- Total comprehensive income

- The following items must also be disclosed in the statement of comprehensive income as allocations for the period: (IAS 1.83)

- Profit or loss for the period attributable to non-controlling interests and owners of the parent

- Total comprehensive income attributable to non-controlling interests and owners of the parent

- No items may be presented in the statement of comprehensive income (or in the income statement, if separately presented) or in the notes as extraordinary items.

Maximize Your Accountant Relationship

Small business owners need to know How to read an Income Statement and need them at least quarterly, which means you should talk to your accountant if you’re not receiving them. Accountants Strategy For Struggling Businesses often starts with analyzing the income statement. Accountants Can Help Key Performance Indicators which are statistical indicators of critical business operations. Contact an Accountant or Certified Public Accountant for assistance.

How to read an Income Statement

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » How to read an Income Statement