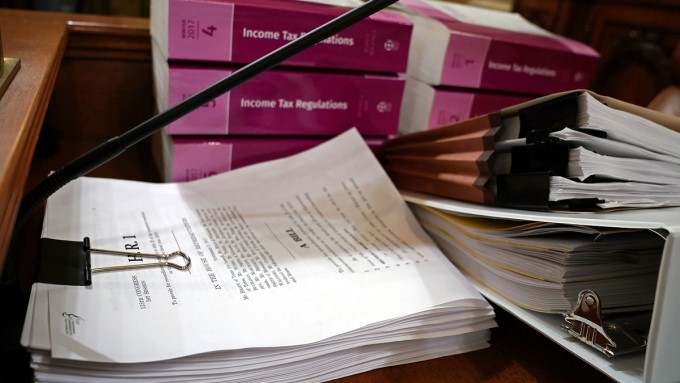

How the new tax law will affect your clients’ S corporations

How the new tax law will affect your clients’ S corporations

With the passage of the sweeping tax overhaul, small businesses and entrepreneurs are scrambling to understand how the changes will affect them. Much of 2018 will be spent figuring out all the implications, but that doesn’t stop anxious clients from turning to you now to figure out how to make the most of the changes.

For small businesses, the most pressing changes are the reduction in the tax rate for C corporations and the 20 percent tax deduction for pass-through entities. As such, we need to retool conventional thinking and help clients decide whether they should structure their business as a C Corp or a pass-through entity.

While the dust is still settling, here are some of the key considerations that small businesses should be thinking about in light of the new tax landscape:

What to know about the pass-through deduction

Before the new plan, people who owned small pass-through businesses typically paid income taxes based on their individual tax rate. For taxable years beginning after Dec. 31, 2017 and before Jan. 1, 2026, individuals can generally deduct 20 percent of their qualified business income from a pass-through entity (like an S Corp, partnership or sole proprietorship). This is a big change, and of course, the devil is in the details. Here are some of the key things your clients should know:

There are limits. The deduction phases out beginning at $157,500 of income for single taxpayers and $315,000 for couples filing jointly.

- If your clients weren’t familiar with the term “qualified business income” before, they will be now. QBI is the net amount of income, gain, deduction and loss with respect to the trade or business. QBI does not include investment-related income or loss, such as capital gains or losses, dividend income or interest income.

- QBI also doesn’t include whatever is paid to the taxpayer as reasonable compensation for their services. In addition, QBI excludes certain service businesses, such as the fields of accounting, health, law, engineering, architecture, financial services, etc., where the principal asset of the business is the reputation or skill of one or more of its employees.

- And, QBI does not include any amount paid to the individual by an S corporation that is treated as reasonable compensation for their services. So if your client owns 50 percent of an S corporation that pays them $50,000 in wages and allocates $100,000 of income, then their QBI from the S Corp only includes the $100,000 of income (not the $50,000 of wages). Surely, there will be many who will want to shift their payments so there’s less in wages and more in income in order to increase the amount of their QBI and thus, increase the amount of the 20 percent deduction. However, everyone needs to keep in mind that the IRS expects reasonable compensation for the services performed and work done. And just as the IRS has monitored this closely to ensure that individuals weren’t improperly avoiding FICA or self-employment taxes, we can expect the IRS to look closely to ensure that individuals who conduct work for S corporations are reporting proper compensation for their services.

Corporation tax rates are attractive but remember double taxation

One of the central tenets of the Tax Cuts and Jobs Act is the reduction of the C corporation tax rate from 35 to 21 percent. This may lead some pass-through entities to wonder if they’d be better off as a C Corp instead. While the corporate tax rate has been reduced to an attractive 21 percent, there still remains the concept of double taxation. When income is earned by the corporation, it’s first taxed at the business level. Then, when the corporation distributes its income to shareholders, the shareholder pays tax on the dividend.

With strategic planning and tax guidance, taxpayers may be able to reduce some of their tax liability by forming a C Corp now—but in many cases if an entrepreneur is looking to take the bulk of the profits out of the business (rather than re-investing it back into the business), a pass-through entity will be preferable.

The bottom line? The pass-through deduction is tricky business, and there are no standard guidelines yet. CPAs and financial professionals will most likely need to look at each client’s situation on a case by case basis. There will be no shortage of work for everyone in the coming year.

Here are some thoughts:

- S corporations are still advantageous in many situations, though are increasingly risky in others— particularly in passive income situations (such as rental real estate income).

- C corporations shouldn’t necessarily look to elect S Corp status just because of this tax bill, especially if the corporation isn’t contemplating a sale or closure in the foreseeable future. While the corporate tax rate is “permanent,” the deduction based on QBI is set to expire at the end of 2025 (it could also be eliminated by Congress after 2020).

- Business owners should continue to think about their business structure in terms of their specific business needs and practices, as opposed to focusing solely on the changes from the Tax Cuts and Jobs Act. It’s also smart to wait for the IRS to release additional guidance on abusive situations.

- And lastly, one of the key advantages in forming a corporation remains the ability to minimize the personal liability of the business owners. This advantage is unaltered by the new tax bill.

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » How the new tax law will affect your clients’ S corporations