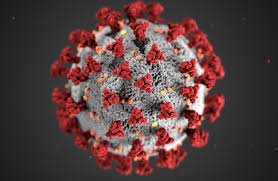

Has Coronavirus changed accounting forever?

Coronavirus changed accounting forever. More Accountants will go Remote saving time and money resulting in more time dedicated to client’s objectives

The global health and economic crisis triggered by Coronavirus is a heavy burden for businesses. Even those for whom remote working is possible had to solve the problem of accessing the data they need to stay operational.

Coronavirus Changed Accounting with More Accountants Working Remotely

Traditional accounting software is typically installed on a dedicated computer drive, only accessible by a licensed user through a desktop application on their machine. Now take your accountant out of the office and ask them to work from home.

They no longer have access. You cannot simply leave receipts or invoices on their desk to process. They can’t chase payments, because they don’t know who has paid, or not paid. And so on…

Fortunately, as Coronavirus changed accounting , Accountant in Miami will have to adapt. Accountants and CPA’s will evolve to a point that cloud accounting software resolves all these accessibility issues. Accounting software has, in most instances, been moved to the cloud, and what a relief that is in unprecedented times like these.

The global spread of COVID-19 has contributed enormously to the sudden surge of businesses moving over to cloud-based accounting software. It’s an industry that had been seeing robust growth anyway, but the necessity of making changes to continue functioning has pushed some business owners off the fence.

But what is the difference between cloud and traditional accounting software?

There are three major differences between traditional accounting solutions and their newer, cloud-based accounting cousins: how accessible they are, how easy it is to grow, and how much it costs.

Accessing accounting during the lockdown

Cloud-based software essentially means that your accounting data is stored on a remote server, Coronavirus changed accounting moved access through a highly secure online interface, anywhere with an internet connection. Unlike traditional accounting software, users are not restricted to a single machine from which to access what they need, so access doesn’t stop when the building closes.

It means that data is no longer stored locally, and instead provides multiple authorized users with round-the-clock access to real-time information. Managers, accountants, clients, and accountants can all even be in different places and time zones and yet continue to monitor and control the business’s financial health.

Growing accounting with the business

Growing the business can be expensive business for users who rely on traditional accounting software. Hiring special needs people who could not leave their house? Better buy more computer storage, upgrade the local server, and increase the bandwidth access to it as well. If you don’t, things can slow down, and suddenly two accountants are working at the rate of one.

The Coronavirus changed accounting impacts accounting practices has forcefully demonstrated the sheer versatile scalability of cloud accounting. It’s up to the software provider to manage server space, speed, and performance, and usually for the cost of a monthly subscription, which is much more financially flexible.

And that brings us to cost

Fewer local servers mean less real estate is needed to house them. That is certainly one way to reduce the expenses that come with a larger property footprint.

Most cloud accounting software providers offer access based on a monthly or annual subscription fee, usually, including all the server storage you could need.

The software is online and updates itself at the source. No more paying for the IT team to come out and install updates on everyone’s machine.

At times like these, businesses tend to either grow or shrink rapidly, whether that’s long or short term. Monthly subscriptions offer flexibility to businesses who need to furlough or hire staff on a rapid turnaround.

This can apply to many industries and businesses. Consider your options. Coronavirus changed accounting may be the best thing we ever did.

Has Coronavirus changed accounting forever?

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma