Fixed Fee Value Pricing

Fixed Fee Value Pricing is About Pricing the Client, not the Service. If your flat fee is the same and does not consider the client needs, not value pricing.

If you are billing a Fixed Fee Value Pricing (predetermined before you even talk to the customer or chosen from a menu of prices listed on your website) monthly fee, feel free to call it value billing. But do not call it Value Pricing! They are radically different, and I cannot say (or hear) it enough times. Pricing the customer is the whole point, representing the foundation of the entire concept of value pricing. It is also possibly the most difficult to truly grasp. After all, value is subjective.

As an Accountant I switched to Fixed Fee Value Pricing 20 years ago. I met each client individually to explain the new system. “Your biggest fear is they won’t like it and will go away”. “Our attrition rate was extremely low. the only ones who walked were those that weren’t paying us anyway.”

Fixed Fee Value Pricing Does Not Mean You are Value Pricing

Value pricing is about pricing the CUSTOMER, not the SERVICE.

Our Accounting Firm has known this all along and we put in writing everything we promise to do. “They don’t feel they’re being nickel and dimed to death every time they call with a question,” said managing partner Gustavo A Viera at Accountants in Miami.

Yet most Accountants are reluctant to go ahead and convert their practice into a value billing one. “A Fixed Fee Value Pricing agreement, tied in with an engagement letter, defines the engagement terms prior to starting work, and enhances client perception of the Accountant value”, said Gustavo Viera”.

“Clients know exactly what we are providing and how much it will cost up front,” he said. Our Accounting Firm knows exactly which services need to be done for the client—each line on the value-pricing agreement becomes a task to be completed on our Miami Accounting Firm’s practice management software.

I generally see four common approaches to billing for services:

- Hourly Billing – A simple formula (hours worked multiplied by hourly rate) is used to create an invoice. There is an inherent conflict because clients are often surprised at the end if hours worked are higher than anticipated. Slow paying customers are often silently protesting what they perceive to be an unfair bill.

- Value Billing – Value billing is usually based on hours worked and an artificial limit of what we believe a client will pay. We usually make internal decisions to “eat” time rather than risk conflict with a fee sensitive client.

- Fixed-Price Agreements – Fee discussions are held with clients before work begins. We clearly lay out the framework for the engagement, including payment terms, deliverables, and overall scope of work to be performed. Clients love the certainty and are generally happy with fixed-price agreements. Opponents to fixed-price agreements worry about losses and cost overruns. You can mitigate this risk by knowing your costs up front and by avoiding scope creep. Scope creep, or doing additional work for free, can be avoided by clear client communication. You must train your team to identify out-of-scope work immediately and communicate with clients to negotiate change orders before the additional work is started. Fixed-price agreements usually include terms for an advance retainer or monthly fees. I recommend a simple menu of services to assist you with pricing.

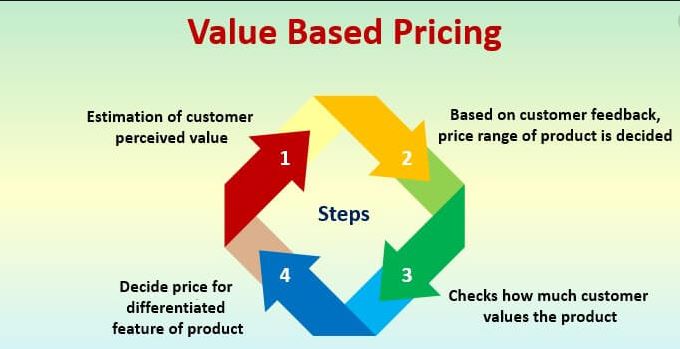

- Value Pricing – This is the ideal model in theory. However, it is also harder to implement in practice. Similar to fixed-price agreements, value pricing requires up front discussions with your client. Value pricing is unique in that we attempt to determine exactly how much value a client places on our services. We strive to build value by identifying business pain and tailoring our solution accordingly. We maximize our revenue by determining the maximum amount that each client is willing and able to pay for our services. Value pricing can be very rewarding and build loyal client relationships if you can clearly demonstrate your value. Value pricing has two common objections:

- We are gouging clients: identifying needs and offering high quality solutions at a fair (and agreed) price is not gouging.

- Clients talk, and they will know that I charge different fees: Good. Then, they will also know that each client pays based on their specific needs and solutions. No two businesses are identical and have identical needs, so how can we expect that fees be the same?

- Large CPA Firms like EY and PWC have also adopted Value Based Pricing as technology reduced the amount of work, and therefore the number of hours they can bill.

Fixed Fee Value Pricing

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » Fixed Fee Value Pricing