The Balance Sheet

The Balance Sheet

The Balance Sheet is one of three financial statements is a summary of the financial balances of company assets, liabilities, and equity.

In financial accounting, The Balance Sheet or statement of financial position or statement of financial condition is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership LLP, a corporation, private limited company, or other organization such as Government or not-for-profit entity. Assets, liabilities, and ownership equity are listed as of a specific date, such as the end of its financial year. The Balance Sheet is often described as a “snapshot of a company’s financial condition”. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year.

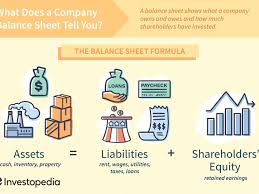

A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in the order of liquidity. Assets are followed by liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth or capital of the company and according to the accounting equation, net worth must equal assets minus liabilities.

Another way to look at the balance sheet equation is that total assets equal liabilities plus owner’s equity. Looking at the equation in this way shows how assets were financed: either by borrowing money (liability) or by using the owner’s money (owner’s or shareholders’ equity). Balance sheets are usually presented with assets in one section and liabilities and net worth in the other section with the two sections “balancing”.

A business operating entirely in cash can measure its profits by withdrawing the entire bank balance at the end of the period, plus any cash in hand. However, many businesses are not paid immediately; they build up inventories of goods and they acquire buildings and equipment. In other words: businesses have assets and so they cannot, even if they want to, immediately turn these into cash at the end of each period. Often, these businesses owe money to suppliers and tax authorities, and the proprietors do not withdraw all their original capital and profits at the end of each period. In other words, businesses also have liabilities.

Guidelines for balance sheets of public business entities are given by the International Accounting Standards Board and numerous country-specific organizations/companies. The standard used by companies in the USA adhere to U.S. Generally Accepted Accounting Principles (GAAP). The Federal Accounting Standards Advisory Board (FASAB) is a United States federal advisory committee whose mission is to develop generally accepted accounting principles (GAAP) for federal financial reporting entities.

The Balance sheet account names and usage depend on the organization’s country and the type of organization. Government organizations do not generally follow standards established for individuals or businesses.

If applicable to the business, summary values for the following items should be included in the balance sheet: Assets are all the things the business owns. This will include property, tools, vehicles, furniture, machinery, and so on.

Assets

Current assets

- Accounts receivable

- Cash and cash equivalents

- Inventories

- Cash at the bank, Petty Cash, Cash On Hand

- Prepaid expenses for future services that will be used within a year

- Revenue Earned In Arrears (Accrued Revenue) for services done but not yet received for the year

- Loan To (Less than one financial period)

- Non-current assets (Fixed assets)

Property, plant, and equipment

Investment property, such as real estate held for investment purposes

- Intangible assets such as (patents, copyrights, and goodwill)

- Financial assets (excluding investments accounted for using the equity method, accounts receivables, and cash and cash equivalents), such as notes receivables

- Investments accounted for using the equity method

- Biological assets, which are living plants or animals. Bearer biological assets are plants or animals which bear agricultural produce for harvest, such as apple trees grown to produce apples and sheep raised to produce wool.

- Loan To (More than one financial period)

Liabilities

Accounts payable

- Provisions for warranties or court decisions (contingent liabilities that are both probable and measurable)

- Financial liabilities (excluding provisions and accounts payables), such as promissory notes and corporate bonds

- Liabilities and assets for the current tax

- Deferred tax liabilities and deferred tax assets

- Unearned revenue for services paid for by customers but not yet provided

- Interests on loan stock

Equity / capital

The net assets shown by the balance sheet equals the third part of the balance sheet, which is known as the shareholders’ equity. It comprises:

- Issued capital and reserves attributable to equity holders of the parent company (controlling interest)

- Non-controlling interest in equity

Formally, shareholders’ equity is part of the company’s liabilities: they are funds “owing” to shareholders (after payment of all other liabilities); usually, however, “liabilities” are used in the more restrictive sense of liabilities excluding shareholders’ equity. The balance of assets and liabilities (including shareholders’ equity) is not a coincidence. Records of the values of each account in the balance sheet are maintained using a system of accounting known as double-entry bookkeeping. In this sense, shareholders’ equity by construction must equal assets minus liabilities, and thus the shareholders’ equity is considered to be a residual.

Regarding the items in the equity section, the following disclosures are required:

- Numbers of shares authorized, issued and fully-paid, and issued but not fully paid

- Par value of shares

- Reconciliation of shares outstanding at the beginning and the end of the period

- Description of rights, preferences, and restrictions of shares

- Treasury shares, including shares held by subsidiaries and associates

- Shares reserved for issuance under options and contracts

- A description of the nature and purpose of each reserve within owners’ equity

The Balance Sheet

The Balance Sheet

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Accounting & Bookkeeping Services » The Balance Sheet