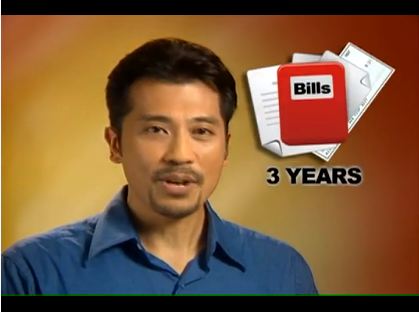

Accountants note that you can throw away most supporting tax records after three years. But keep your returns indefinitely.

How long do I need to keep my tax records in case I get audited? Are there some records I should keep longer?

It’s a good idea to keep your returns indefinitely. But accountants note you can generally toss supporting tax records three years after the tax-filing deadline, which is the time the IRS generally has to initiate an audit. Several states have four years to initiate an audit (you can find out about the rules from your state department of revenue or taxation; see the IRS’s archive of state tax agencies). Accountants emphasize that the federal audit period extends to six years if you under-report your income by 25%, so I recommend that you hold on to all records for 7 years.

Supporting documents you should hold on to for at least three years include your Form W-2s or Form 1099s reporting income; other 1099s reporting capital gains, dividends, or interest; Form 1098 if you deducted mortgage interest; canceled checks and receipts for charitable contributions; and records showing expenses for other deductions and credits. Also, keep records showing eligible expenses for withdrawals from health savings accounts or 529 college-savings plans. If you have business expenses, keep records of those costs, such as equipment purchases, phone bills, business travel, and marketing expenses. If you claimed a home-office deduction, keep records of your rent or mortgage interest, homeowners or renters insurance, real estate taxes, utilities, and other eligible expenses. Keep receipts showing any tax-deductible retirement-savings contributions, such as to a deductible IRA, simplified employee pension, or solo 401(k). Also keep Form 1095 showing that you had eligible health insurance, or records showing that you met the criteria for an exemption.

You’ll need to hold on to some tax records longer than the three-year audit period. Accountants note that one of the biggest mistakes people make is not keeping records that establish the basis of property and investments; those are used to determine the taxable gain or loss when you sell. “The most elusive information seems to be the basic information,” says Gustavo A Viera CPA in Miami Fla. You should keep purchase records for mutual funds, stocks, and other investments held in a taxable account for at least three years after you sell the investment because you’ll need to report the purchase date and price when you file your taxes for the year they are sold. Brokers must report the cost basis of stock purchased in 2011 or later, and of mutual funds and exchange-traded funds purchased in 2012 or later, but it helps to keep your own records in case you switch brokers. If you inherit stocks or funds, keep records of the value on the day the original owner died to help calculate the basis when you finally sell the investment (and for at least the three-year audit period after that). Also, keep records of reinvested dividends that you’ve already paid taxes on so you won’t be taxed on them again when you sell the stock.

Keep records of your home purchase for at least three years after you sell your home, as well as records of any significant home improvements that add to your home’s value, such as the cost of adding an extension or a new kitchen. Up to $250,000 in home-sale profit is excluded from taxes if you’re single (or up to $500,000 if you’re married filing jointly) if you live in the house for at least two of the five years leading up to the sale. But you could end up with a tax bill if you don’t live there that long or if your profits are higher. In that case, you can add the cost of those capital home improvements to the cost basis of your home when you sell and reduce any capital gains. See IRS Publication 523, Selling Your Home, for more information about the expenses that can be added to your basis.

Keep Form 8606 showing any nondeductible IRA contributions until all of your IRA money is withdrawn (plus at least the three-year audit period) so you can prove you’ve already paid taxes on the contributions and won’t be taxed on them again.

If you have a business, you should keep records for any assets that are still used in the business or are being depreciated, says accountant Viera.

For more information about the rules for keeping tax documents, see IRS Tax Topic 305 – Recordkeeping

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma