Florida Grants a Penalty Waiver – Then Takes it Back

What’s wrong with this Penalty Waiver Notice?

Florida businesses act as collection agents for the Florida Department of Revenue. When a customer walks into Sunset Jewelers to buy a watch, the merchant tacks on an additional 7% for Florida Sales Tax. At month end, the merchant like every other business closes it’s books, and has until the 20th of the following month to remit sales tax collected on behalf of the state. If the merchant files and remits monies due to the state late, they get hit with penalties.

We assist many clients the preparation and submission of the monthly report, and subsequent payment. The whole process is online and takes less than 5 minutes. The state grants a “Penalty Waiver” once every three years if a business is late filing. That is reasonable I guess, so why am I fed up with local, state and federal tax agencies? This answer is simple, they are slowly pulling the rug out from underneath small businesses feet and no one seems to notice, or worse, care!

So what is wrong with this penalty waiver notice the State of Florida so graciously and proactively handed out, without asking for it? Have you ever played Monopoly? Do you remember the “Get of of Jail Free” card? The Penalty Waiver is Florida’s equivalent of Monopolies Get of of Jail Free card. Once you use the card in the famous board game, the next time you land in jail, you have to stay.

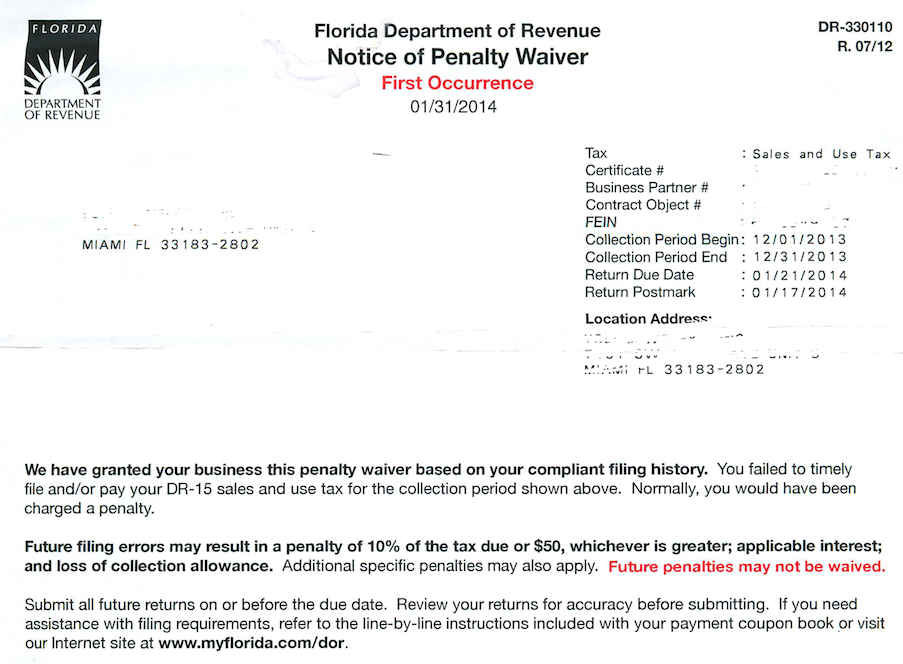

The State of Florida has subtly stolen this businesses one chance to use the “Penalty Waiver” when and if you really need it. Remember you get one every three years. I sent this out to clients with a challenge to find the mistake with the incentive of a gift card. No one got the answer correct. Enough suspense, the tax collection period here is Dec 1 to 31st 2013. The due date is January 21st 2014. And the return was e-Filed by us and paid on January 17th, 2014 (4 days Prior to the Due Date).

So why is the State granting the business owners an unsolicited and unwarranted waiver for failure to timely file? According to the SBA, as of the end of December 2010 there were 1,074,000 businesses in the State. Statistically speaking there is a high probability that a business will file late at least once in a period of 36 month. I am going to simplify the math, and use a linear approach to this. If the State strips businesses right to legally use the waiver, and using the very minimum penalty of $50 x 1,074,000 businesses translates into additional $53.7M revenue for the state.

You may say this is not a big deal, why make a fuss. Maybe you missed this headline a couple of days ago.

FCC backs down from study, won’t ask journalists how they gather news.

The First Amendment to the Constitution has been under attack from the Administration, but finally backs down on “study” on how the news gathers news. One of the FCC commissioners went public, asking why the agency was collecting information on how newsrooms gather their information. Uproar over a government research project questioning reporters on their news-gathering has caused the Federal Communications Commission to rethink its approach. The overwhelming consensus among those close to the scandal stated “This is the beginning to the end of free speech”. Thankfully the media has the money and means (TV, Radio and Print) to spread the word quickly and they cried FOUL at the top of their lungs.

Have we become to fat, happy and pumped full of Rx pills to make us feel good to care anymore?

Wake Up Fellow Americans!