2021 Tax Policy Outlook

Tax Policy Outlook with President Bidens Administration appears that taxes will rise while trying to survive the economic impacts from the pandemic.

The ongoing pandemic, economic challenges, and political divisions exemplified by the tumultuous events of recent weeks will affect the prospects for significant tax legislation and other policy changes this year. At the same time, the outlook for action on President Joe Biden’s campaign proposals has improved since the results of the Congressional Georgia Senate runoff elections gave Democrats effective control of the Senate, with Democrats also holding a slim majority in the House.

President Biden has made it clear that his priority is to address the pandemic and its economic fallout, even as the Senate considers an article of impeachment of former President Donald Trump. Meanwhile, the new Biden administration and Congress have begun active discussions of the president’s ‘Build Back Better’ recovery proposals that rely on increased taxes from corporations and high-income individuals to offset part of the cost of his plans.

With major US tax policy changes under consideration, global tax policy also remains in a state of flux as the pandemic increases revenue challenges for other nations. Negotiations are ongoing over the Organization for Economic Co-operation and Development (OECD) proposed changes to longstanding international tax rules, and globally engaged businesses are facing the risk of even greater cross-border tax controversy.

International trade relations and business supply chains also are being redefined. The United States and other countries are seeking to address disagreements with China over trade and a range of other issues. New trading patterns are being forged in North America under the United States revised free trade agreement with Canada and Mexico and in post-Brexit Europe, as well as in other parts of the world.

In this environment, business leaders need to assess the potential effects of changing policies in the United States and around the world and to engage actively with policymakers. Companies should consider speaking ‘early and often’ with Democratic and Republican members of Congress as well as the new Biden administration about how the policy issues discussed in this outlook—corporate and individual rate increases, potential increased taxation of foreign operations, and a host of other proposed changes to the US, state, and foreign tax laws—may affect your business. Business outreach efforts also should include results of modeling the effect of potential tax changes on competitiveness, business investment, and job creation.

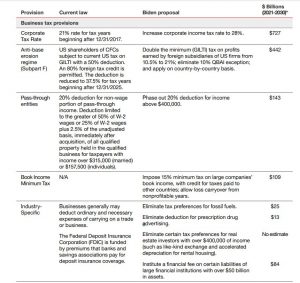

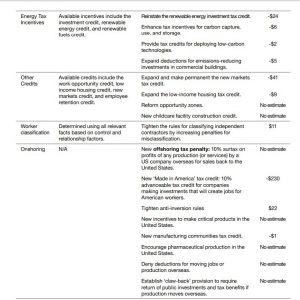

Biden’s tax proposals During his campaign, Biden proposed several business and individual tax increases that are intended to offset in part the cost of his ‘Build Back Better’ recovery agenda. Key business tax proposals include:

- Increasing the US corporate tax rate to 28%,

- Imposing a 15% minimum tax on companies’ global book income, and

- Doubling the current minimum tax on profits earned by foreign subsidiaries of US firms, raising it from 10.5% to 21%.

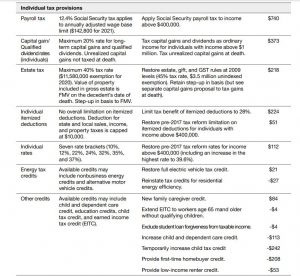

President Biden has proposed significant changes to individual tax provisions both to offset the cost of his broader policy agenda and as part of his efforts to address income inequality. Key individual tax proposals include:

- Rolling back income and estate tax reductions from the 2017 tax reform act (the 2017 Act) for taxpayers with incomes above $400,000; and

- Taxing capital gains and dividends as ordinary income for individuals with income above $1 million, while making other changes that would limit the ability of individuals to use current ‘step-up in basis rules.

- New rules requiring capitalization of research expenditures, set to take effect in 2022.

- Further limiting of interest deductions, by denying an add-back for depreciation and amortization (also set to take effect in 2022); and

- Full expensing rules for a qualified property are set to phase out, beginning in 2023.

Biden pandemic recovery tax proposals

President Biden on January 14 released an outline of pandemic relief proposals that include:

- $1,400 per person direct payments (for a total of $2,000 when combined with the $600 payments approved in December).

- $400 per week in enhanced unemployment benefits through September 2021 (and automatically adjusted depending on health and economic conditions).

- Extending eviction and foreclosure moratoriums and rental assistance.

- Extending nutrition assistance programs.

- Raising the minimum wage to $15 per hour.

- Expanding childcare assistance; and

- Temporarily expanding childcare tax credits, making the child tax credit fully refundable, and expanding the earned income tax credit.

Biden business tax proposals

During his presidential campaign, Biden proposed several business income tax changes to pay for part of the cost of his proposals. The most significant business tax change in terms of revenue involves raising the corporate income tax rate from 21% to 28%. In addition to increasing the statutory corporate income tax rate, Biden proposes doubling the tax rate on global intangible low-taxed income (GILTI) and a new 15% alternative minimum tax on global book income.

As discussed below, Biden also has proposed rolling back key individual tax provisions from the 2017 Act for those with incomes above $400,000, including the Section 199A 20% deduction for pass-through business income. This is estimated to affect more than 60% of pass-through business income.

Corporate rate increase

Biden has proposed increasing the federal corporate tax rate to 28%. The 2017 Act provided a 21% corporate rate, down from the 35% rate that had been in effect since 1993. In the intervening decades, other countries reduced their corporate tax rates significantly, so the US combined federal and state corporate rate had become the highest among OECD countries.

Observation: The 2017 tax reform legislation was the product of years of bipartisan efforts to make the US tax system more competitive globally, even though the 2017 Act was ultimately enacted with only Republican votes. As noted above, some House and Senate Democrats are expected to have concerns about increasing the current 21% corporate tax rate and other Biden tax increase proposals. For example, Senator Manchin has stated that he would not support increasing the corporate tax rate above 25%.

If a 28% federal corporate income tax rate were enacted, the US combined federal and state rate once again would be the highest among OECD countries, as shown in Figure 12. The OECD average corporate tax rate, excluding the United States, is 23.4%.

Biden individual tax proposals

Under the 2017 Act, the highest individual income tax rate was reduced from 39.6% to 37%. As enacted under the budget reconciliation process, the individual income tax rates and brackets are scheduled to sunset after 2025, along with other key individual tax provisions discussed below.

Biden has proposed to return to pre-2017 Act tax rates for taxpayers earning more than $400,000; this would include restoring the highest rate to 39.6% for those taxpayers. He also would limit the Section 199A pass-through deduction for individuals with income above $400,000; as noted above, this would affect more than 60% of pass-through business income.

Currently, an individual’s capital gains tax rate is based on their taxable income, with 20% being the maximum rate. The separate tax on net investment income increases the maximum rate to 23.8%.

Biden has proposed to make significant changes to the current way in which capital gains are taxed. These include taxing long-term capital gains and qualified dividends at ordinary tax rates for taxpayers whose adjusted gross income (AGI) exceeds $1 million. For qualifying taxpayers, this modification would tax long-term capital gains and qualified dividends in the same manner as short-term capital gains and ordinary dividends, respectively.

In addition, Biden is proposing that unrealized capital gains over $100,000 are taxed at death or upon gift, as opposed to waiting until the sale or exchange of the asset. It appears the $100,000 exclusion would likely be on a per-individual basis. Exceptions to this treatment would include assets passing to the taxpayer’s spouse or charity.

Senate Finance Committee Chairman Wyden also recently noted his proposal to change the tax treatment of capital gains. Wyden has proposed taxing not only realized capital gains but also accrued unrealized capital gains, by including the change in the market value of assets (gain or loss) every year in the income of their owners for federal income tax purposes. This so-called mark-to-market approach seeks to eliminate the ability of taxpayers to defer paying taxes on unrealized gains by delaying the sale of an appreciated asset. In addition to raising revenue by collecting tax before the assets are sold, the proposal seeks to avoid the revenue loss from reduced capital gains realizations by eliminating the ability of taxpayers to defer taxes by holding on to assets. Senator Wyden’s proposal generally would apply to taxpayers with annual incomes above $1 million and/or ‘covered’ assets above $10 million.

Note: President Biden did not propose changing the capital gains tax treatment of the ‘carried interest’ of certain partnership investment income during his campaign. The 2017 Act extended the holding period for certain carried interest income to qualify for preferential capital gains treatment. House Ways and Means Committee Chairman Neal and Senate Finance Committee Chairman Wyden have stated that they plan to revisit the issue of carried interest. Numerous bills have been proposed over the years by Congressional Democrats to eliminate capital gains treatment for carried interest.

Since the Tax Reform Act of 1986, there have been nine capital gains tax rate changes: two rate increases and seven rate decreases. Both the 1986 rate increase and a subsequent rate increase enacted in 2010 were prospective.

The 2017 Act made notable changes to itemized deductions. These changes, which are scheduled to sunset after 2025 along with the other individual tax provisions include:

- Repealing the ‘Pease limitation,’ which increased marginal tax rates by limiting the deduction for home mortgage interest, state and local taxes, charitable contributions, and miscellaneous deductions.

- Limiting the home mortgage interest deduction on new mortgages to the principal of $750,000 (instead of $1 million).

- Capping the state and local tax (SALT) deduction at $10,000.

- Suspending the miscellaneous deductions subject to the 2% floor; and

- Increasing the charitable contribution limitation to 60% of AGI (for 2020 and 2021 only, raised to 100% by COVID relief legislation enacted last year). Biden has proposed to cap the value of itemized deductions at 28% for taxpayers earning more than $400,000. Biden also has supported the repeal of the SALT deduction cap.

Social Security taxes

Currently, the Social Security payroll tax is based on the 6.2% tax rate for both the employee and employer on the $142,800 wage base for 2021; the wage base is updated annually for an inflation cost-of-living adjustment. Self-employed individuals pay a combined 12.4% Social Security tax rate.

Biden has proposed to impose the 12.4% Social Security tax for income that exceeds $400,000. It is not clear if this additional tax would be borne solely by the employee or split between the employer and employee.

Biden campaign tax proposals

2021 Tax Policy Outlook

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » accountancy service » 2021 Tax Policy Outlook